What is money?

Cash, bread, scratch, funds, greenbacks, and my favorite from my friend Ian, “Fun Vouchers” are all nicknames for that stuff of which most of us wish we could collect more.

But what is it really? Where does it come from? Perhaps most importantly, why does it seem to buy less and less as time goes on?

After helping create and then helping operate the most popular “Honest Money” website (goldismoney2.com) for over ten years, I’ve been researching, discussing, debating, arguing, and explaining simple economic concepts for some time.

When one is surrounded by really smart people, discussing topics of mutual interest, and nearly constantly expanding one’s own knowledge about those topics, it’s easy to forget that there are many people who are new to the subject.

The subject today is money.

While there have been many commodities used as a medium of exchange over the millennia, gold and silver remain the gold standard (pun intended). Both have a stable level of rarity, a definite (if somewhat variable) cost of production (digging it out of the ground, minting coins, etc.), and let’s face it, homo sapiens like shiny stuff!

There is a reason that the best of the best of virtually any field is often called the “Gold Standard” and that’s because gold is, well, the standard.

Here in our United States, we look to the Coinage Act of 1792 for the definition of our money. The Coinage Act was passed in order to comply with Article I, Section X of the Constitution of the United States which says, “No state shall make any thing but gold and silver coin a tender in payment of debt.”

The pain of inflation and debt resulting from the issuance of paper money during the Revolutionary War fresh in their minds, this very early Congress wanted to ensure that there were clear standards and definitions regarding money in our young country. The Act sets precise weight and content standards for gold and silver coins and fixes their ratio of value at 15 to 1. In other words, a one Dollar silver coin would weigh 15 times more than a one Dollar gold coin, but have the same value. This makes sense because it roughly parallels the geologic ratio of silver to gold contained in this rock we call, “Earth.”

The Founding Fathers, many of whom were part of the Congress that passed the Coinage Act, thought they were ensuring that American money would always have intrinsic value, which is to say the coins would have value in and of themselves. One could melt them down to make ingots, jewelry, etc. and the gold or silver itself would still have value. It’s interesting to note that there was a time when an individual could take their own silver or gold to the mint and have them minted into coins. There have been a number of new monetary and banking laws passed since the Coinage Act, not the least of which is the Federal Reserve Act of 1913, but these have really been nothing but legislative excuses to violate Article I, Section X.

Making gold and silver the standard for American money was intended to prevent banks from being able to cheat the people with paper money. The Federal Reserve Act of 1913 was intended to enable them to do just that, with the enforcement power of the United States Government to help them.

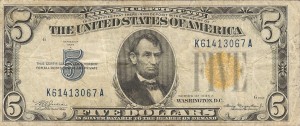

Getting back to gold and silver money, eventually, it became inconvenient for people to carry large amounts of money (silver and gold are heavy!) so certificates were issued, payable on demand, to the bearer, by the US Treasury. These kinds of certificates are a type of money known as a “warehouse receipt.” They are proof the actual lawful money (according to the Constitution) does exist and can be claimed by the bearer anytime. Here’s a look at a fairly modern-day Silver Certificate:

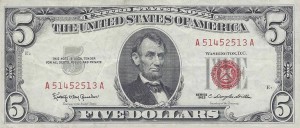

During the Civil War, Abraham Lincoln needed money to keep the Union afloat and he was decidedly against dealing with bankers so he had the Treasury issue what are known as “United States Notes” which do not have a precious metal backing and have value only by fiat (decree). The notes issued by President Lincoln were printed in green ink and earned the (pejorative, at the time) moniker “greenbacks” a nickname which has ended up being used to refer to all US paper money. They are a type of “fiat money” that go into circulation when the government spends them. Here’s an example of the last series of United States Notes ever issued (by order of President Kennedy in 1963):

The grandaddy of all fiat money is the Federal Reserve Note (FRN). Through the magic of fractional reserve banking, this piece of monetary fiction springs into existence when someone borrows it (like when the government borrows from the Federal Reserve or the consumer borrows from their local bank to buy a new car). The Federal Reserve Banks, as well as your local bank, have license to create these notes out of thin air. They use the borrower’s ability to pay (produce) as justification for their producing this money. There is a formula from the Federal Reserve that sets the requirements for funds on deposit in order to create a certain amount of money. They like to pretend that this formula is some kind of monetary control to properly manage the economy but really, it’s just to ensure that all the banks are working under the same limitations to make sure that when they settle accounts each day, no bank comes up short because they issued too much (fake) money.

Here’s a picture of an FRN so the reader can see the difference between it and the other two:

A silver certificate is always worth the specified amount of silver (until of course the Treasury stops honoring them). There is no inflation. The amount of silver certificates in circulation cannot be legally and honestly increased without the corresponding amount of silver being increased as well.

United States notes are inflationary. They increase the amount of money in the “pool” of circulating money without adding value. Each one issued steals a little value from the ones already in circulation. This causes the prices to rise because the value of each individual dollar is diluted by the newly issued ones. Fiat money is not in the long-term best interest of the people but it does have some short term advantages in that they do not impose an immediate burden on the people (politicians don’t want to get caught inflicting any kind of pain on the people) and once they are issued (spent) by the government, that’s it. They are part of the pool and they circulate with the rest of the dollars. The government doesn’t have to pay anyone back. The direct cost (to the government) of these funds is fixed at the cost of printing (manufacturing).

Federal Reserve Notes are inflationary just like United States Notes but they have another disadvantage. The government has to borrow them from the Federal Reserve, which means we (the people) have to pay them back! Yes, that means every FRN in your wallet is a debt. It eventually must be repaid to the Federal Reserve.

Think of the pool of money in circulation expanding and contracting as money goes in and out of it. Someone borrows money, and that amount is added to the pool. When someone makes a payment on their loan, that money is subtracted from the pool. If the banks slow or even stop loaning money, the money flows out of the pool and back to the bank. Since no more money is flowing back into the pool in the form of loans, the pool of money out there for all of us to earn gradually gets smaller and smaller.

Since only the principle goes into the pool when money is borrowed, the interest is never created. That means there isn’t enough money in the pool to pay all the debts.

Let me repeat that:

There isn’t enough money in the pool for all debts to be paid. There never has been enough money in circulation for all debts to be paid. There was never supposed to be enough.

The system is designed so that the banking cartel, led by our decidedly non-government central bank (The Federal Reserve System), can adjust the amount of money they lend to control the amount of money in circulation. Through periodic “boom and bust” cycles, they first finance development, construction, etc. and then shut off the money supply so they can seize the very assets they financed with money created out of thin air.

The mechanism for creating money is not well-known, even among banking “executives.” The bankers (i.e. OWNERS of the banks have to hold this information very close because if they don’t, Henry Ford’s prediction would come true:

It is well enough that people of the nation do not understand our banking and monetary system, for if they did, I believe there would be a revolution before tomorrow morning.

I once had a conversation with the Senior Vice President (Lending) of a large Midwestern Bank and he had no idea where the money his organization lends comes from. He admitted it never occurred to him to think about it. (Loan officers are in the SALES business). I debated for weeks with a colleague whose family owned several banks who was convinced I was wrong about how FRN’s come into existence. Finally one day at lunch, he picked up the phone and called his uncle to discuss it. The uncle explained to him how they manufacture money and I heard him say, “So that’s what you call the money multiplier?”

He hung up the phone and told me I was right.

So please let me summarize this slightly-longer-than-normal Diatribe:

Money is a commodity just like milk, natural gas, or pork bellies.

It is a commodity traded for other commodities and subject to the law of supply and demand just like other commodities. If the supply of dollars is increased (inflated), the value of each individual dollar decreases. The reverse is also true.

Banks are not just business started by folks with lots of money to lend.

Banks are factories.

Their product is money.

Thanks for reading.

cma

Read more on this subject in Honest Money, Carl’s new book on money and banking or visit Carl’s Amazon Author’s page.

5 Responses to Money Defined (Banks too!)

Leave a Reply

You must be logged in to post a comment.

Good post! We will be linking to this particularly great content

on our site. Keep up the great writing.

I am sure this paragraph has touched all the internet users, its really really pleasant article

on building up new blog.

Hi there, I enjoy reading through your article.

I wanted to write a little comment to support you.

Cynthia,

On the books page, there is one just published called, “Honest Money.”

Will be available in Kindle format in a day or two.

cma

Carl – really appreciated the clarity this provided. When I read the book I got a little lost in the banking chapter. I’m going to revisit after reading this. Keep em coming! Thanks for your unique talent for writting